19th October 2023

Opposing equity movements, DIS’ burden of trust and a surprising Top 10 fund are revealed in latest MPF data

MPF Ratings’ September quarter MPF Asset Class Fund Flows Summary has now been uploaded.

Key points are as follows:

- MPF recorded a Q3 estimated net inflow of $11.0bn, compared to Q1’s $15.3bn and Q2’s $13.2bn, to take MPF year-to-date inflows to $39.5bn(See Table 1).

- MPF’s total assets stood at $1.088tr at the end of Q3 2023 (up 3.47% YTD), an average account balance equivalent per 4.69m membersof $231,700.

- Behind the headlines. MPF’s largest asset class HK and China equities recorded a quarterly net outflow for the first time since Q4 2020 while US Equities attracted 42.2% of MPF’s total net inflows, its biggest recorded quarterly net inflow gain. (Also see Table 1).

- Despite only being launched on June 5th, Sun Life’s MPF Global Low Carbon Index Fund was amongst the Top 10 most popular funds, attracting the 9th highest net inflows out of the 404 MPF constituent funds (See Table 3).

- Mixed Asset Funds recorded MPF’s largest Q3 net outflows, but positively the Default Investment Strategy (DIS) funds attracted net inflows equivalent to roughly 3 times their combined market share (see Table 1). Members appear to trust MPFA’s guidance to utilise the mandated low fee, well diversified, long term fund option(s).

- Amongst the MPF Sponsors, Manulife, Sun Life and BOCI-Prudential were the biggest winners in Q3’s race for MPF net inflows.

Francis Chung (叢川普), Chairman of MPF Ratings Ltd, Hong Kong’s independent Mandatory Provident Fund (MPF) research specialist today released MPF Ratings’ September quarter 2023 MPF Fund Flow Report by highlighting a significant number of shifts in MPF’s fund flow pattern including a big move away from MPF’s largest asset class and surprising interest in ESG investing.

Quotes:

Surprising and material shifts in MPF fund flows

“Q3 saw some surprising and big fund flow movements. While US equities attracted approximately 42% of MPF’s $11bn worth of net inflows, Hong Kong and China equities saw net outflows for the first time in almost three years. Notably too, traditional mixed asset funds saw MPF’s largest outflows but positively this appears to be due to members switching into DIS fund(s) and placing trust in the MPFA mandated long term focused, low fee and well diversified fund options.“

New ESG fund amongst the Top 10 most popular MPF Constituent Funds

“Perhaps the biggest surprise was Sun Life’s newly launched MPF Global Low Carbon Index Fund ranking amongst MPF’s top 10 funds by net inflows. Launched on June 5th, it ranked 9th out of 400+ MPF Constituent Funds. The MPFA should welcome this early success given their ESG ambitions and their recognition that ‘Sustainable investing will become the ‘new normal’ in the financial industry’.”

Manulife, Sun Life and BOCI-Prudential were MPF’s biggest Scheme Sponsor winners

“While Manulife garnered the largest share of MPF money in the past quarter, Sun Life and BOCI-Prudential were also big winners. All three gaining more share of inflows than their overall market share which means they’re taking overall market share from the rest of the market.”

Table 1: MPF Asset Class Fund Flows for Q3 and First 9 Months of 2023

Source: MPF Ratings

Table 2: MPF Scheme Sponsor Fund Flows for Q3 and First 9 Months of 2023

Source: MPF Ratings

Table 3: Top 10 Highest Inflow MPF Constituent Funds for Q3 2023

Source: MPF Ratings

*Excluding assets from scheme merge of Sun Life MPF Master Trust into Sun Life Rainbow MPF Scheme on 30 August 2023

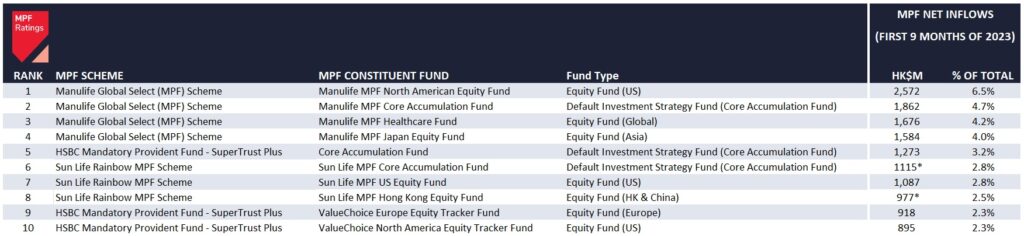

Table 4: Top 10 Highest Inflow MPF Constituent Funds for First 9 Months of 2023

Source: MPF Ratings

*Excluding assets from scheme merge of Sun Life MPF Master Trust into Sun Life Rainbow MPF Scheme on 30 August 2023