14th July 2022

1H 2022’S DATA HIGHLIGHTS MPF’S STRENGTH

MPF Ratings’ June quarter MPF Asset Class Fund Flows Summary has now been uploaded.

Key points are as follows:

- MPF’s estimated loss of -12.96% (as measured by MPF Ratings’ MPFR All Fund Performance Index) is worst 1H calendar year return since its December 2000 inception.

- MPF total assets are currently at an estimated $1.058tr, with average account balances for MPF’s 4.59m members totalling approximately $230,700 (a decline of -10.5% since the beginning of 2022).

- Despite poor performance MPF system records highest 1H calendar year net fund inflows in four years, with an estimated net inflow of $29bn (See Chart 1), driven by record TVC contributions and capped off by an estimated $13.71bn in Q2 net inflows despite soft financial markets.

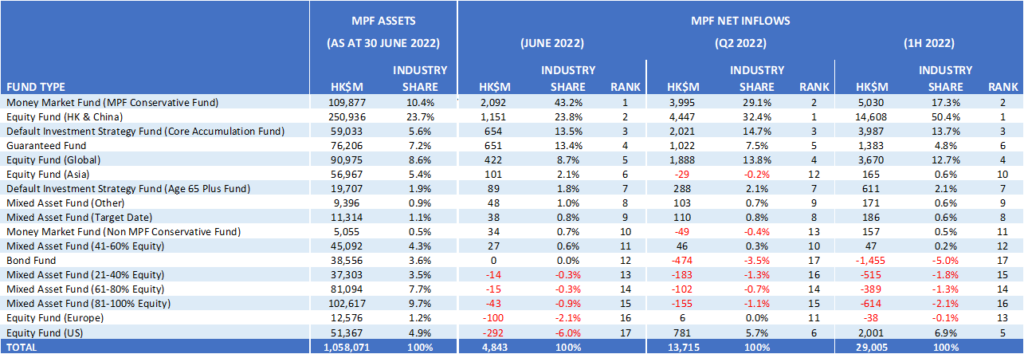

- Unsurprisingly MPF’s Conservative Fund is amongst the top 3 most popular asset classes. Notably HK & China equities, despite producing negative returns in 4 out of 6 months of 2022, continues to attract strong support and so too does the DIS Core Accumulation Fund as members heed the message to remain invested and well diversified during volatile markets.

- European and US Equities saw the largest outflows in the month of June as inflation and recession concerns continue to worry investors.

Francis Chung (叢川普), Chairman of MPF Ratings Ltd, Hong Kong’s independent Mandatory Provident Fund (MPF) research specialist today released MPF Ratings’ June quarter MPF Asset Class Fund Flows Summary by highlighting the confidence members are placing on the MPF system in a difficult investment climate while calling for further incentives to encourage saving for retirement.

Quotes:

Despite market uncertainty MPF attracts record net inflows

“MPF has attracted an estimated $13.71bn in the June quarter, taking first half 2022 net inflows to approximately $29bn which, on average and despite the acute uncertainties currently affecting global markets, is almost 10% higher than in the past three years.”

Reasons for MPF’s strong net inflows

“Confidence, security and flexibility are essential in times of uncertainty. The MPF system offers members all three. Additionally, members are realizing that through the mandated Default Investment Strategy (DIS), and through Tax Deductible Voluntary Contributions (TVC), MPF is a relatively low cost and tax effective savings platform.”

Impact of TVC and calls for additional incentives to encourage long term self-funded retirement

“Since the introduction of Tax Deductible Voluntary Contributions (TVC) in 2019, the March quarter has seen average net inflows increase by over 200% into TVC accounts. With an estimated $13.71bn in net inflows, it appears demand has carried into the June quarter too. TVC driven demand for MPF shows savings incentives work and we encourage further incentives to promote self-funded savings for retirement.”

Table 1: MPF Asset Class Net Fund Inflows as at 30 June 2022

Chart 1: 1H MPF Net Fund Inflows from 2019 to 2022

Table 2: MPF Scheme Sponsor Net Fund Inflows as at 30 June 2022

Table 3: Top 10 MPF Constituent Fund Net Fund Inflow Winners for June 2022

Table 4: Top 10 MPF Constituent Fund Net Fund Inflow Winners for Q2 2022

Table 5: Top 10 MPF Constituent Fund Net Fund Inflow Winners for 1H 2022

Table 6: Bottom 10 MPF Constituent Fund Net Fund Inflow Losers for June 2022

Table 7: Bottom 10 MPF Constituent Fund Net Fund Inflow Losers for Q2 2022

Table 8: Bottom 10 MPF Constituent Fund Net Fund Inflow Losers for 1H 2022