27th August 2021

Confidence in local equity markets remain despite falling into bear market territory

MPF Ratings’ July MPF Asset Class Fund Flows Summary has now been uploaded to MPF Ratings’ media education portal.

Key points are as follows:

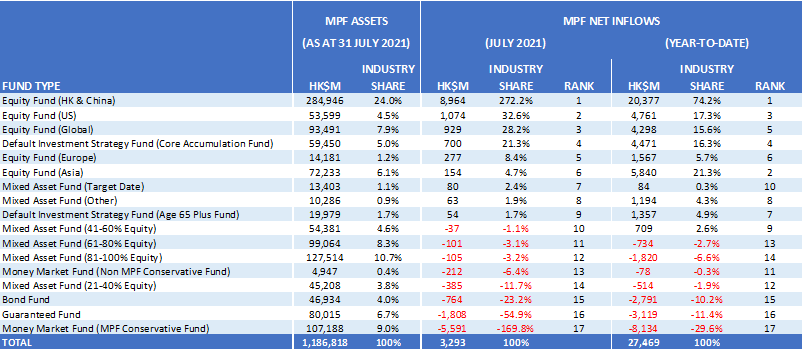

- HK & China Equity Funds attracted a record 272% of MPF’s net inflows in July as MPF members took advantage of improved valuations as local equity markets recorded big falls (See Table 1).

- Defensive asset classes (MPF Conservative, Guaranteed and Bond funds) suffered most as members invested in local equities, recording a combined net outflow share of approximately -248% (See Table 1).

- Despite the volatile fund flow movements and concerns over Hong Kong permanent departures, total MPF net inflows remained robust in July, recording a total net inflow of $3.29bn (See Table 1).

- MPF members ignored sharp falls in local equities to reallocate their MPF in July. MPF Ratings’ MPFR Equity Fund (HK & China) Index declined -9.54% in July, the worst 1-month return since October 2018.

- Notably the -9.54% MPFR Equity Fund (HK & China) fall translates to a year-to-date loss of -5.02%, the first time local markets have shown a YTD loss.

- While MPF members appear confident about the future of HK and China equities, the sharp fall in HK & China equity markets in July sees MPF’s total asset size fall from the record high of $1.221tr at end of June to $1.187tr at end of July, or the equivalent average MPF member account balance size of approximately $261,000 per MPF’s 4.5m members, down from $269,000 in the previous month.

MPF Ratings Ltd, Hong Kong’s independent Mandatory Provident Fund (MPF) research specialist today released their July MPF Asset Class Fund Flows Summary by highlighting record monthly inflows into MPF’s Hong Kong and China equity fund category.

When releasing MPF Ratings’ monthly MPF Asset Class Fund Flows Summary, Francis Chung (叢川普), Chairman of MPF Ratings noted that despite record losses in local equities as Hong Kong’s equity market was spiralling towards bear market territory, MPF members invested record contributions in Hong Kong and China equities.

What do record MPF inflows into Hong Kong and China equities say about MPF member confidence?

“Despite MPF Ratings’ Equity Fund (HK & China) Index recording its worst monthly loss since October 2018, MPF members invested unprecedented amounts in local equities. The switch from defensive funds offering minimal returns, such as Conservative and Guaranteed funds, reflects MPF members’ chase for better returns. Despite speculation over US tapering measures and concerns over Mainland technology companies MPF members see equities as the best place to invest and the correction in Hong Kong equities appears to offer members a cheaper entry point into Hong Kong and China equities.”

Table 1: MPF Asset Class Fund Flows as at 31 July 2021

Source: MPF Ratings

Table 2: MPF Scheme Sponsor Fund Flows as at 31 July 2021

Source: MPF Ratings

Table 3: Top 10 MPF Constituent Fund Inflow Winners for July 2021

Source: MPF Ratings

Table 4: Top 10 MPF Constituent Fund Inflow Winners for Year-to-Date 2021 (as at 31 July 2021)

Source: MPF Ratings