5th September 2022

Annual average MPF loss exceeds $38,000 after August’s $5,000 decline

MPF Ratings’ August MPF Performance Survey has now been uploaded.

Key points are as follows:

- MPF produces a loss of -2.16% or -$23bn in the month of August (the equivalent of -$5,000 per MPF’s 4.59m MPF members). Year-to-date losses have grown to approximately -$176.8bn, or -$38,500 per MPF member.

- After factoring in MPF contributions, August’s average MPF member account balance is expected to be approximately $227,400, a decrease of $4,100 over the month.

- Total MPF assets are expected to end the month at approximately $1.043tr, a monthly decrease of $19bn from the previous month.

- Federal Reserve Chairman, Jerome Powell’s Jackson Hole speech reinforces biggest risks to MPF returns.

- Key risks highlight the need for diversification.

According to independent provider of MPF research, views and opinions, MPF Ratings, the MPF system saw monthly loss of -2.16% in August (as measured by MPF Ratings’ MPFR All Fund Performance Index). The loss is the MPF system’s 7th monthly loss in 2022, and according to MPF Ratings’ Chairman, Francis Chung (叢川普), the latest comments from Federal Reserve Chairman, Jerome Powell, at Jackson Hole reinforces that the key risks to financial markets remain undiminished, highlighting the importance of diversification and remaining focused on long term investing objectives.

Quotes:

Stubborn inflation means higher interest rates

“Inflation, interest rates and recession concerns continue to persist. After Jerome Powell’s Jackson Hole speech, the US Federal Reserve has put global financial markets on notice that it will act aggressively to manage inflation. This means higher interest rates and the possibility of slowing global economic growth.”

What should MPF member do?

“Volatility creates mispricing opportunities but such mispricing also highlights the need for MPF members to remain well diversified. Every MPF scheme offers Default Investment Strategy (DIS) funds. They’re low fee ready-made diversified fund options and for many MPF members DIS may be an excellent option to consider.”

Table 1: 1-month and year-to-date MPFR Index returns as at 31 August 2022

Source: MPF Ratings

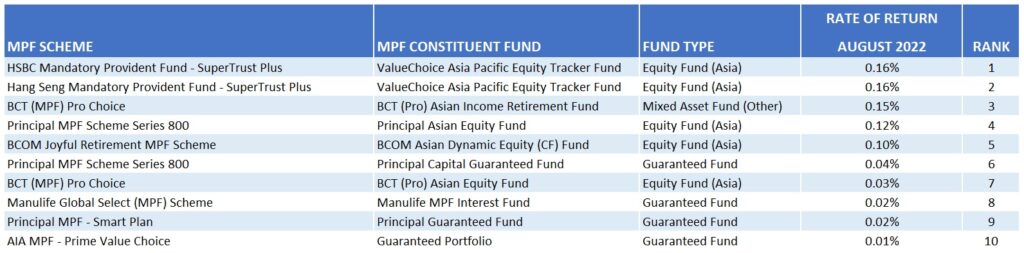

Table 2: 10 best performing MPF constituent funds for the month of August 2022

Source: MPF Ratings

Table 3: 10 worst performing MPF constituent funds for the month of August 2022

Source: MPF Ratings