16 October 2020

Latest MPF data suggests members are anticipating strong HK and China equity performance

MPF Ratings, an independent MPF specialist research group, today released their September quarter MPF Asset Class Fund Flows report. At an estimated HK$1.02 trillion, the report confirms total MPF assets remain above HK$1 trillion but the major highlight was the huge reversal of MPF fund flows in and out of Hong Kong and China equities, and MPF Conservative Funds.

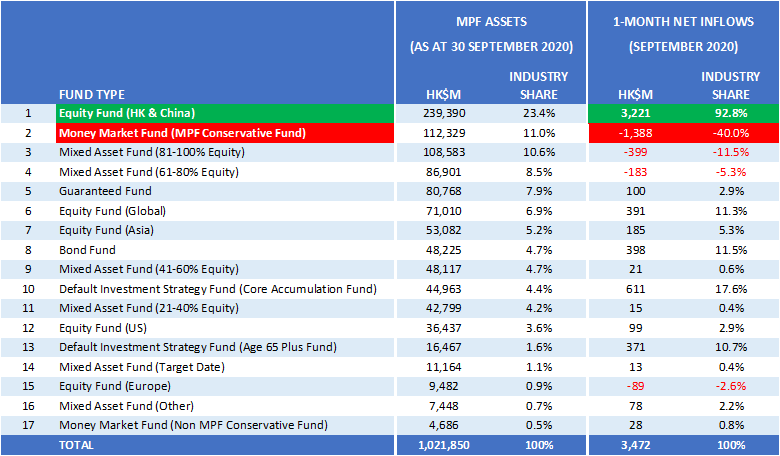

According to MPF Ratings, in September MPF attracted an estimated HK$3.47bn in net inflows, with an estimated HK$3.22bn, or an astonishing 92.8% going into Hong Kong and China equities. Conversely, MPF’s 2nd largest segment, MPF Conservative Funds saw an estimated -40% in outflows, the equivalent of -HK$1.39bn (See Table 1).

Table 1: Industry Share of MPF Assets as of 30 September 2020 and MPF Fund Flows for September 2020 (by Fund Types)

Source: MPF Ratings

The data appears to suggest MPF members are anticipating strong HK and China equity market performance, but what’s of concern to MPF Ratings’ Chairman, Francis Chung (叢川普), is the data also shows members are second guessing markets in the short term rather than adopting a long term and diversified investment approach. “An estimated 93% of net MPF inflows going into Hong Kong and China equities is in itself astonishing, but when combined with a net outflow of -40% from MPF Conservative Funds, the result is extraordinary. MPF members are shifting money from MPF’s least volatile funds to invest in one of MPF’s most volatile fund categories. Ordinarily such short term investment behaviour carries significant risks, but within a retirement system such as MPF, where the focus should be on long term investing and diversification, these risks are magnified even further.”

When Mr Chung was asked if he believed changing the investment behaviour of MPF members would lead to better investment outcomes, he was blunt in his assessment. “Absolutely. Timing markets is imprudent. In the last twelve months we’ve seen some of the most volatile markets in MPF’s 20 years of existence and if there’s one thing the past year should have taught MPF members it’s that ‘time in market’, not ‘market timing’ that is important to achieving long term retirement goals.” Mr Chung then went further and offered MPF members a suggested solution, “MPF is long-term so members should remain invested, diversified and focus on their retirement objectives. All MPF schemes are obliged to offer the Default Investment Strategy (DIS) Fund options. They’re low cost, well diversified and take away the burden and risk of chasing short term performance.”